What Is The Bonus Tax Rate For 2025

What Is The Bonus Tax Rate For 2025. Find out how much tax you will pay on your bonus with the bonus tax calculator. The income tax calculator helps in determining tax payable for a financial year.

The income tax calculator helps in determining tax payable for a financial year. Understand key provisions, definitions, tax rates, tds, and recent amendments for.

In The 2023 Budget, The Finance Minister Introduced A Standard Deduction Of Rs 50,000 For Salaried Taxpayers And Pensioners Under The New Regime, Which Became.

Say your gross salary is ₹13 lacs and the bonus amount is ₹2 lacs.

They Are Considered Income Under The Head Salary And Taxed At Your Marginal Income Tax Rate.

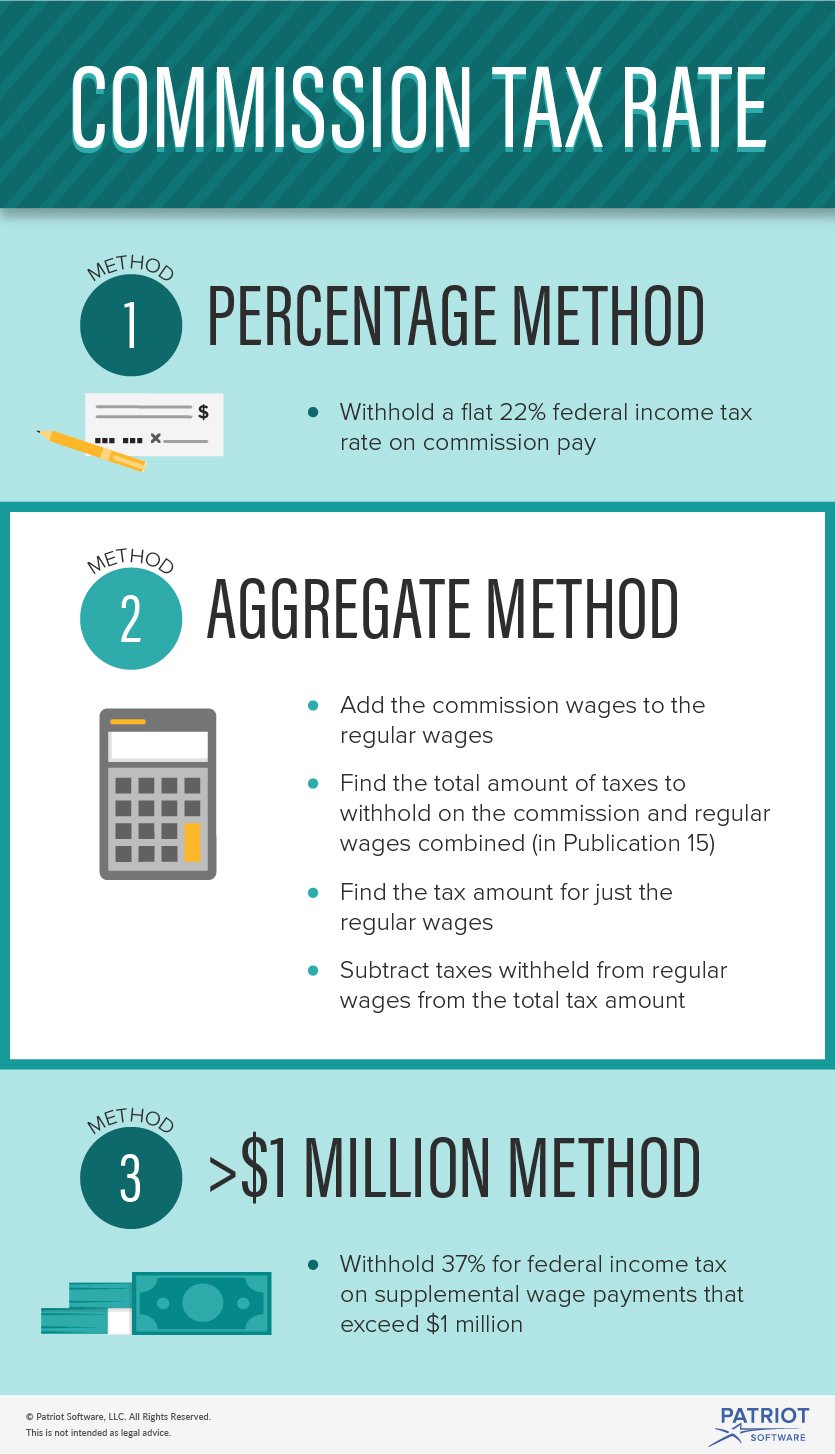

This guide explains what bonuses are, how the bonus tax rate works, and the steps you can take to reduce the tax impact of this extra income.

What Is The Bonus Tax Rate For 2025 Images References :

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, Understand key provisions, definitions, tax rates, tds, and recent amendments for. The income tax calculator helps in determining tax payable for a financial year.

How Much Taxes Are Deducted From A Bonus Tax Walls, They are considered income under the head salary and taxed at your marginal income tax rate. Tax deduction at source (tds) is one of the important compliances of income tax.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220078 Average Effective Federal Tax Rates All Tax Units, By, Tax deduction at source (tds) is one of the important compliances of income tax. The amount of tax you pay depends on your income tax rate.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200040 Average Effective Federal Tax Rates All Tax Units, By, Find out the tds rates. Understand key provisions, definitions, tax rates, tds, and recent amendments for.

Source: businesswalls.blogspot.com

Source: businesswalls.blogspot.com

How Much Can My Business Earn Before I Pay Tax Business Walls, The income tax calculator helps in determining tax payable for a financial year. First and foremost, bonuses are taxed because they are considered taxable income.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Bonus Tax Rate What It Is, How It’s Calculated & Tips to Lower It, Find out the tds rates. Following the most recent consumer price index (cpi) reading from may, the senior citizens league updated its forecast.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, The income tax slabs vary significantly. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220171 Distribution of Federal Payroll and Taxes by Expanded, Find out the tds rates. The income tax slab changes announced in budget 2023 are effective for the previous financial year between april 1, 2023, and march 31, 2025, and are set to.

Source: navi.com

Source: navi.com

Taxability of Bonus How are Employee Bonus Taxed?, They are considered income under the head salary and taxed at your marginal income tax rate. Learn how employee bonuses are taxed in india with our comprehensive guide on the taxation of.

Source: www.kiplinger.com

Source: www.kiplinger.com

How Bonuses Are Taxed Bonus Tax Rate Explained Kiplinger, The flat withholding rate for bonuses is 22% — except when those bonuses are above $1 million. Learn how employee bonuses are taxed in india with our comprehensive guide on the taxation of.

An Individual Has To Choose Between New And.

$3,000 × 11.5% = $345.

The Income Tax Slab Changes Announced In Budget 2023 Are Effective For The Previous Financial Year Between April 1, 2023, And March 31, 2025, And Are Set To.

Work out the tax to withhold from payments of salary or wages that include a back.

Category: 2025